2017. “U.S. monetary policy and commodity prices : the financialization Hypothesis”, Review of Economic and Business Studies, Volume 10, Issue 2, pp. 53-77, (Rachida Hennani et Nicolas Huchet)

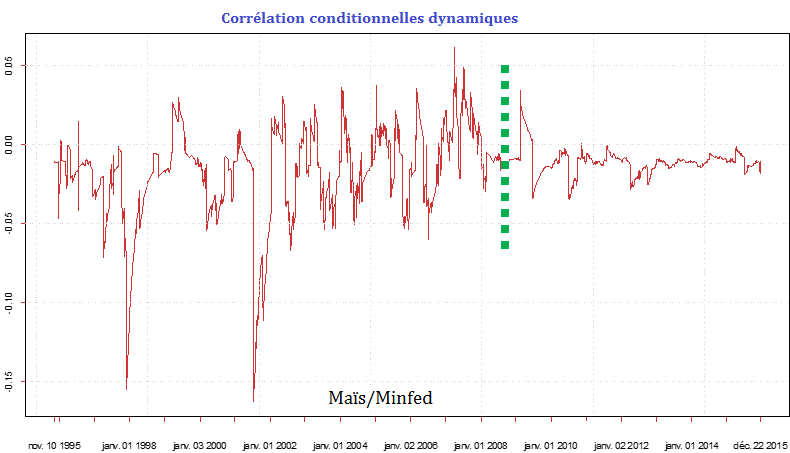

Abstract: The growing instability of agricultural commodity prices since 2000 has entailed serious challenges for developing economies. However, there is no consensus about the likely prices' impact of markets' financialization. For instance, some recent studies show that speculation on derivative markets partly drives agricultural prices. Other studies point out the growing correlation within commodity markets (with a special role for oil) and between physical and financial or monetary markets, notably the U.S. monetary policy. The purpose of this paper is to revisit the monetary and financial drivers of many agricultural prices over time through a DCC-GARCH model, over the period 1995-2015. In addition to oil prices, stock-market index (S&P 500) and volatility (VIX), interest variables consist of the U.S. long-term sovereign interest rates, the uncertainty with regard to monetary policy decisions and the stabilization of daily interest rates with regard to the Fed fund target. Agricultural commodities are coffee, wheat, corn, soybean, sugar and rice. We find that agricultural markets support the financialization hypothesis, as indicated by the growing conditional correlation between agricultural prices and oil prices, S&P 500 and VIX indexes. Interestingly, the impact of U.S. monetary policy on agricultural prices has decreased since 2010, which indicates that the implementation of non-standard monetary policy measures (in order to favor financial stability) reduces spillover effects on asset prices, especially raw commodities.